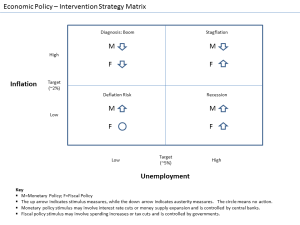

Coronavirus pandemic is a global phenomenon, as of now 160 countries out of 193 recognized countries are affected. Many countries are in lockdown. All the developed countries are affected, therefore, the economy worldwide is severely affected. In this trying time, the whole world needs Keynesian economics. In nutshell, the concept says – “Increase government expenditures and lower taxes to stimulate demand and pull the global economy out of the depression.” Here I am going to discuss my opinion on why companies should choose to spend and continue working on their ongoing plus upcoming projects.

Keynesian economics considers or provides guidelines to the Governments. You can check India approves 1.70 lakh Crore package for poor, $2 trillion package US Congress has approved recently. Apparently, this is the biggest package US or for that matter, any government has approved. Government spending is only one part. I am of the opinion that every industry must seriously consider not only spending but also sustaining employees. Short term “shareholder value” can wait for better long terms sustenance. I know this sounds counter-intuitive – special when all companies are losing revenues due to lockdown, expecting retaining employees and to sustain a business. Surely this will impact the survival of many firms, projections and revenue targets of almost every company and shareholder returns. Let me give you some basic reasoning for my opinion of private firms too should continue their investment and how can it help bring the economy on wheels again.

Due to Coronavirus few industries are directly affected, namely; Airline, Hospitality and discretionary expense items e.g. beauty or apparel. People are going to spend on their basic necessities for the next few weeks or who knows months. The impacts revenue and therefore growth-related projects of these industries. Let us take an example as an explanation.

Example

An apparel company wanted to increase its footprints in a new region. That would require – finding retail space, employees for the store, furniture/store interiors design, products to put in the shelf and technology e.g. internet, hardware, POS and marketing to bring shoppers in-store. Due to the impact of a pandemic the apparel company will delay all these. The domino effect will be on – real estate, prospective employees, interior designers, producers (who produce for the apparel company in terms of aggregate demand), internet service provider, IT company planning to provide hardware and software and the marketing activation agency that was supposed to engage in the project – right from printing flyers. Why I brought flyers? Because this and interior decorators have many unskilled laborer working for them. The result – the domino engulfs many part-time workers. When these part-time workers do not have money they will have an impact on purchasing many other things. A self-fulfilling prophecy – read more about self-fulfilling prophecy here.

At this time, what should private businesses do? At whatever negotiated discounts – they must continue their projects be it starting footprints in new regions as given in the above example. The companies must continue their spending because sooner or later things will fall in place. People will start consuming and the economy will be on track again. If spending is done as usual – the economy will come on its feet faster than it other would. Therefore I am suggesting that after the lockdown due to pandemic – why companies should choose to spend.

Summary

I fell in love with research of McKinsey and company, “Grow Fast or Die Slow” sustaining growth in technology companies. Paraphrase of this research is –

- Growth matters more than margin or cost structure

- No correlation between cost structure and growth rate

Net-net one cannot cost cut to grow the business. Business growth requires “growth”. This is why I suggest that companies should choose to spend. Cost rationalization is important, questions are the discretion, putting costs in the right perspective and strategic decisions on these investments. This is the time when project costs will be more rational compared to a booming economy. At this tough time, many companies will look at cost reduction – what leadership across the globe must know is that – this is the time to look at a big picture and work towards completing the unfinished projects, starting the planned projects and reopen the businesses as usual after lockdown. Why? Because sooner we start spending on our planned projects, sooner economy will be back on track and most importantly we will be able to reach our projections, targets, and shareholder value.

The concept of interdependent co-arising perfectly fits this conclusion. When we keep our investments on, the fund will be available to others to either spend or pay as salary. This spending results in moving the circle of growth.

Related news – Cognizant to offer extra 25% of base salary

Earlier, I wrote on trust as a foundation –

Earlier, I wrote on trust as a foundation –