It all started in 1990s when Japan took the step to deflate its economy – Yen devaluation, lower interest rate, money supply etc. The effect is observed till today and in fact we may get into another slowdown in 2015-16. Actually, that’s what is the fear. Some experts are forcing Euro-zone not to make the same mistake Japan made in 1990s. If one sees debt of the developed countries one may be forced to conclude – we are sitting around next slowdown. Take Japan – about 250% debt to GDP ratio! Surprising right? Nope, situation is not better in US either, USA is also at 100% debt to GDP. Many are already blaming Quantitative Easing for the next likely downfall.

I happened to read a news last month on Keynes failing Japanese economy. Well, I agree with the concept of Keynesian economics; you may even call me anti-capitalistic – though I am not. I am more in the league of following the middle path. May be Japanese have become too devoted of Keynes’ concept – so I started questioning myself on many fronts i. Is Keynesian economics the problem? ii. Did Japan over do it? iii. How things work around here? Etc These questions may be comforting to those who are against the Keynesian economic theory.

Since, Keynesian economics had worked in relatively less connected world of 1930s I dismissed the question 1 for future blog. Japan’s overdoing it and how the system works were somewhat related questions. So, that question became central in my very tiny analysis.

Since, Keynesian economics had worked in relatively less connected world of 1930s I dismissed the question 1 for future blog. Japan’s overdoing it and how the system works were somewhat related questions. So, that question became central in my very tiny analysis.

The question I had was – how does Govt issue bonds and how does it get circulated in the market? Well, that is done through the banks and the bankers. Aha! did I hear bankers? Those bankers who went to the President (USA) and said – “we would buy Jet for our executives?” Ok! If those who still blame Keynes, would you ask with each slow down who makes the most money? Is not it the same – bankers? At least the Govt is putting money in the system in the hopes that this method will work to keep the economy afloat. I was checking Wikipedia article on Economy of Japan. An external states that – Japan possesses 13.7% of the world’s private financial assets (the second largest in the world) at an estimated $14.6 trillion [2010 data]. This data states that – Keynesian economics is doing more services to the Capitalism than otherwise!

[Tweet “Japan has 13.7% of the world’s private financial assets! #Keynesian #economics does more service to #Capitalism than otherwise”]

Who is playing with the hopes and cheating the system? I am little too critical when I say “cheat” because some people are in the profession of making investment decision and those decision at times counter intuitively work against the basic premise (hope) on which at the first place Govt had put money in the system. I think a solution for the problem of Japan or for that matter world economy (likely next economic burst) lies in answer to the question(s) – who has actually hoarded the money? How to make amend for this workaround of Keynesian method of boosting economy?

I asked Prof Mankad about his opinion on Japan. He shared this – “One of the real reasons for Japanese stagnation through the last decade of twentieth century had little to with Japanese policy. It was caused by two important external forces viz., depreciation of dollar (and hence default appreciation of Yen) and rise of ‘low cost’ China which deprived Japan of its traditional export markets. The fault of Japanese policy makers was absence of policy response to the changing situation and rise of China.”

So there is seemingly an emotional explanation [which questions the other side] from my side. There is another more analytical, logical and thoughtful explanation from Prof Mankad. Whichever you want to ponder upon – Keynes did not seem to have failed Japan.

Yet at the same time, every generation needs a revised look at things & our generation too! Keynesian Economics was successful when the world was not that connect, now QE of USA is invested in India/China which did not happen in 1930s.

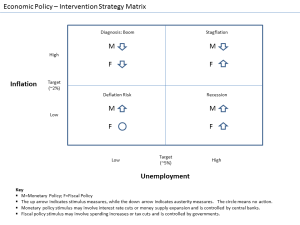

Image source – http://upload.wikimedia.org/wikipedia/en/a/a7/Economic_Policy_-_Intervention_Strategy_Matrix.png